Maximize Your Financial Future: Understanding Good Debt vs. Bad Debt

Can debt ever be beneficial? This comprehensive analysis explores the traits that distinctly separate good debt from bad debt, empowering you with the insights needed to make sound financial choices. Many in society propagate the view that all forms of debt are detrimental, emphasizing the risks associated with toxic debt and the extensive debt crisis impacting numerous lives. However, it’s crucial to acknowledge that certain types of debt can be strategically advantageous when managed properly. By understanding the nuances of good debt, you can set the stage for enhanced financial stability, security, and a wealth of future opportunities.

Harnessing the Power of Debt: The Long-Term Advantages of Strategic Borrowing

A hallmark of good debt lies in its ability to elevate your financial health over time. A quintessential example is a mortgage, which not only provides shelter but also serves as a significant long-term investment. When you secure a mortgage at a favorable interest rate, you not only ensure a place to live but also acquire an asset that tends to appreciate in value over time. By the end of the mortgage term, you could hold a substantial asset that greatly enhances your overall net worth. Similarly, other forms of advantageous debt, such as student loans and small business loans, are specifically designed to boost your professional skills or create income-generating avenues, ultimately leading to greater financial success down the road.

Assessing Your Financial Capacity: The Key to Responsible Debt Management

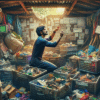

Many households find themselves in debt due to impulsive purchases of luxury items or furniture, often resulting in high-interest loans that foster ongoing financial distress. Such debts are typically classified as bad debt, as the value of the acquired items tends to depreciate almost immediately after purchase. Additionally, these high-interest loans are frequently structured to trap borrowers, making it exceedingly difficult to break free from their financial obligations. This predicament can negatively affect mental health and overall well-being, leaving individuals ensnared in challenging financial situations for extended periods. Therefore, it is vital to thoroughly assess the affordability of any debt you consider, ensuring it aligns with your long-term financial aspirations and goals.

Simplifying Your Financial Journey: Streamlining Debt Payments for Enhanced Control

The easiest debts to manage are those that offer clear benefits and can be consolidated into a single monthly payment. This approach not only alleviates financial pressure but also improves your ability to monitor and manage your finances with greater efficiency. One effective solution for simplifying your repayment efforts is a <a href="https://limitsofstrategy.com/debt-consolidation-loan-calculator-for-effective-budgeting/">Debt Consolidation Loan</a>. This financial instrument allows you to merge multiple debts into one manageable payment, eliminating the confusion and complexity associated with juggling various repayment plans. By consolidating your debts, you can regain control of your financial landscape and concentrate on meeting your financial objectives with renewed focus.

If you think a Debt Consolidation Loan could positively impact your financial situation, contact us or call 0333 577 5626. Our dedicated team is eager to assist you in improving your financial health through a streamlined repayment process tailored to your lifestyle needs.

Explore Trusted Community Resources to Enhance Your Financial Literacy

Identifying Debt Consolidation Scams: Essential Strategies for Protection

Identifying Debt Consolidation Scams: Essential Strategies for Protection

Spotting Debt Consolidation Scams: Proven Strategies for Your Financial Safety

Debt from Coronavirus: Navigating Financial Challenges

Debt from Coronavirus: Navigating Financial Challenges

Overcoming Financial Hardships Post-Coronavirus: Effective Strategies for Your Recovery

Understanding Secured Loans Arrears: What to Expect Next?

Understanding Secured Loans Arrears: What to Expect Next?

Decoding Secured Loans Arrears: Insights into Your Financial Future

Couple Up to Cut Back on Tax: Smart Saving Strategies

Couple Up to Cut Back on Tax: Smart Saving Strategies

Innovative Saving Strategies: Couple Up to Maximize Your Tax Benefits

County Court Judgments Explained: What You Need to Know

County Court Judgments Explained: What You Need to Know

Understanding County Court Judgments: Essential Insights for Financial Awareness

The Article Good Debt and Its Potential Financial Benefits First Appeared ON

: https://ad4sc.com

Comments are closed